|

|

|

|

A few treats about real estate

& technology on a friday |

|

|

|

Dear $[UD:FIRST_NAME||]$,

Bonfire's screens and curates private placement real estate investment prospects for you, our investor community. We created S'mores to share of snack-sized insights from the world of real estate, finance, and other topics we think you will find interesting.

Quick update: Bonfire's allocation into the "Lord Tennyson Apartments" sold out and the Sponsor noted that it is oversubscribed by $5MM. Congrats to those who got in, we are extremely excited about this project as it has the most downside protection of any asset we have seen this year. |

|

|

|

|

|

|

|

|

|

U.S Commercial Real Estate Equity Values Are Down 49% |

|

|

|

Bonfire’s take: With interest rates and cap rates increasing, the paper value of commercial real estate assets are down roughly 22%. But given how powerful leverage is (for better or worse), if commercial real estate values are down 22% it means that roughly half of equity has been wiped out. Someone's loss will become someone's else's gains. More on that below. | |

|

|

|

|

|

|

|

|

|

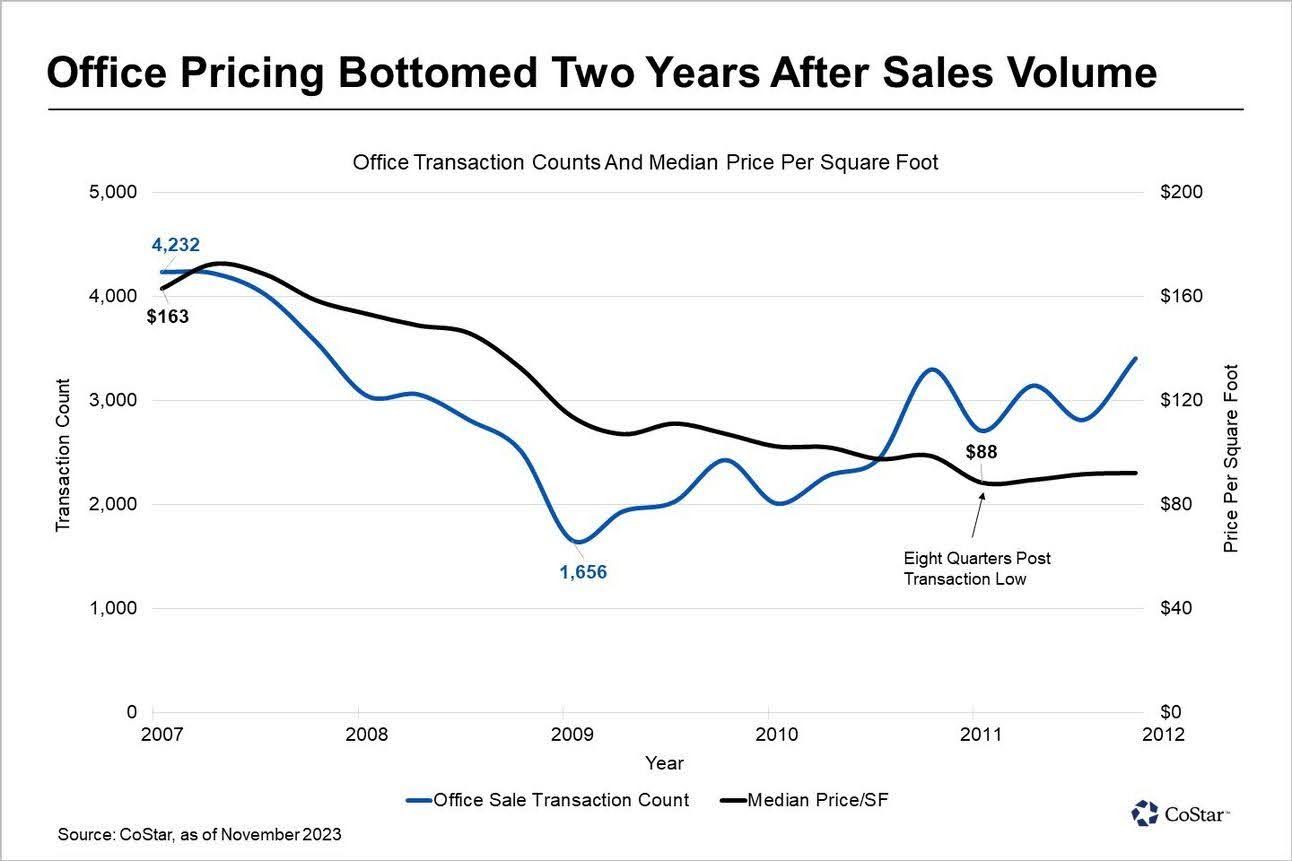

Lag Between Sales Volume & Price

| |

|

Looking back at the 2007 downturn, office (as well as industrial and retail) real estate transaction volumes peaked and then significantly declined, taking two years to hit a low. Despite a 63% increase in transaction volumes over the following two years, office prices per square foot continued to drop, indicating that increased transaction flows can exacerbate price declines. | |

|

|

|

|

|

|

|

|

|

No one is smart enough to market time and call “the bottom.” That said, no one wants to catch a falling knife. Bonfire believes this is the time to be extremely judicious and rigorous with underwriting but have the courage and conviction to capitalize upon distressed opportunities if the right deal comes.

| |

|

|

|

|

|

Credit Card Debt - Canary in the Coalmine?

|

|

|

|

|

|

|

|

|

|

Something we are pondering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thanks and have a wonderful weekend!

Joshua Kagan, CEO, Bonfire

| |

|

To sign up for an account and get access to exclusive passive income opportunities, log onto app.bonfire.capital (it takes 30 seconds and is free!)

About Bonfire - Our mission is to provide investors with carefully curated tax-sheltered cash flow and capital appreciation investment opportunities they wouldn't otherwise have access to.

| |

|

|

|

|

|

|

|

|

|